Aladdin | Avaloq

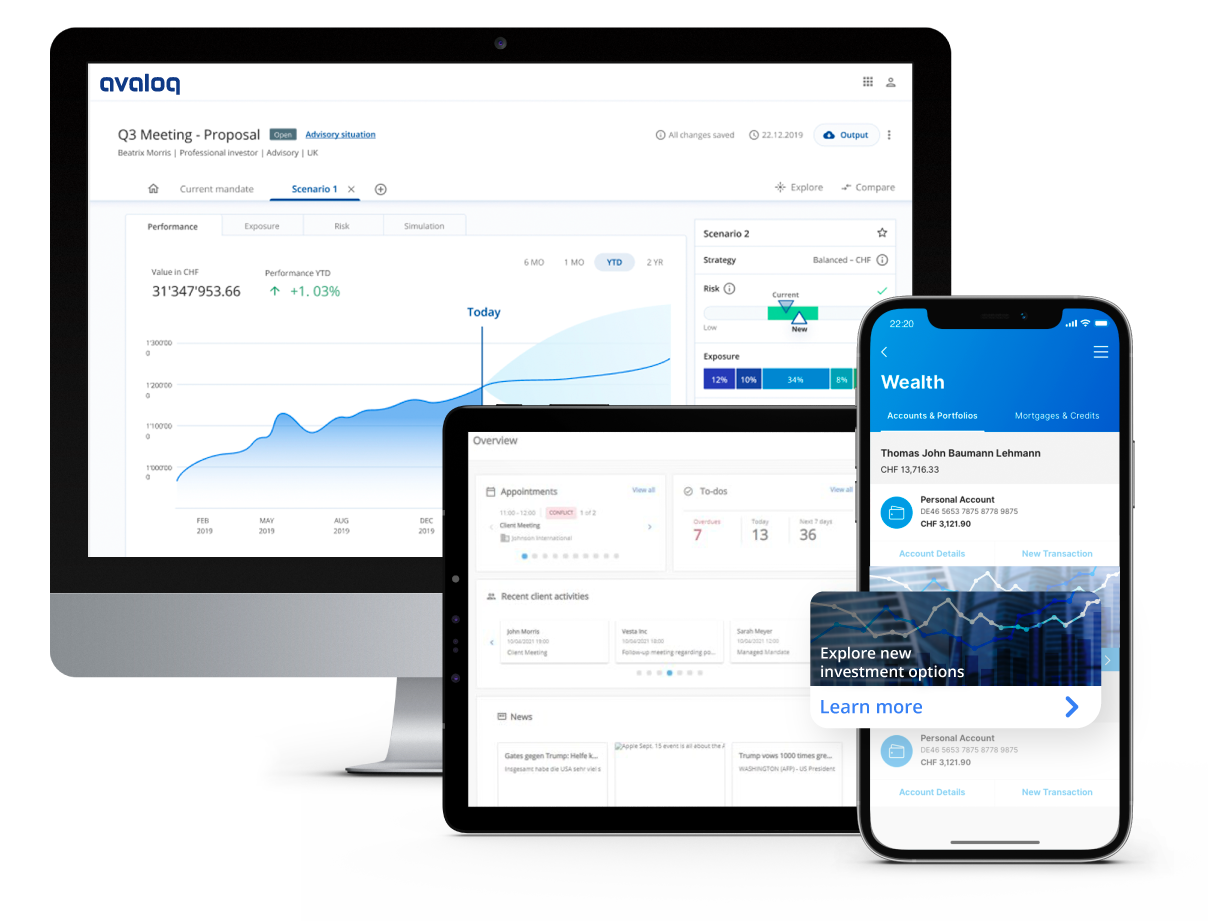

This exciting new offering combines Avaloq’s leading core banking, client relationship management and web and mobile banking services with the Aladdin Wealth™ platform’s poweful risk analytics and portfolio management capabilities.

Donnez de la flexibilité à vos offres, qu’il s’agisse de solutions d’investissement standardisées pour le grand public ou de conseils hautement personnalisés pour les grands et très grands patrimoines.

Profitez de nos connaissances spécialisées et de nos logiciels pour établir des relations solides avec vos clientes et clients, tout en tirant parti de l’automatisation pour gérer, protéger et faire fructifier leurs actifs.

Démarrez votre entreprise plus rapidement grâce à nos solutions basées sur le cloud et passez à la vitesse supérieure dans vos diverses activités. Nous vous aidons également à élargir votre offre de produits et à conquérir de nouvelles zones géographiques tout en limitant les coûts.

Banques privées et gestionnaires de patrimoine

Donnez de la flexibilité à vos offres, qu’il s’agisse de solutions d’investissement standardisées pour le grand public ou de conseils hautement personnalisés pour les grands et très grands patrimoines.

Gestionnaires d’investissement

Profitez de nos connaissances spécialisées et de nos logiciels pour établir des relations solides avec vos clientes et clients, tout en tirant parti de l’automatisation pour gérer, protéger et faire fructifier leurs actifs.

Banques de détail et commerciales

Néobanques et banques challengers

Démarrez votre entreprise plus rapidement grâce à nos solutions basées sur le cloud et passez à la vitesse supérieure dans vos diverses activités. Nous vous aidons également à élargir votre offre de produits et à conquérir de nouvelles zones géographiques tout en limitant les coûts.

Transformez la chaîne de valeur de vos services financiers grâce à une plateforme bancaire performante et à des produits numériques autonomes.

Des établissements financiers et gestionnaires de patrimoine du monde entier voient en nous un partenaire de confiance. Voyez de plus près comment nous avons aidé nos clients à parvenir là où ils sont aujourd’hui.

En mettant nos clients au premier plan, nous avons décroché la première place dans de nombreux classements du secteur. Voici quelques-unes des récompenses et reconnaissances que nous avons obtenues des principaux jurys et analystes mondiaux spécialisés dans la technologie.